Browse Our Website

Start by exploring our website to learn more about our digital banking services. Our user-friendly design makes it easy to navigate through various features, account options, and helpful resources.

Start by exploring our website to learn more about our digital banking services. Our user-friendly design makes it easy to navigate through various features, account options, and helpful resources.

Once you’re ready to take the next step, click on the "Register" button to create your account. Provide your personal information and choose your preferred banking services. The registration process is quick and straightforward, ensuring you can start banking in no time.

After registration, you’ll receive a verification email. Click on the link provided to confirm your email address and activate your account. This step helps ensure the security and accuracy of your account information.

With your account activated, you can now log in and explore our range of digital banking features. To access premium services or special offers, click on the "Subscribe Now" button. Choose the subscription plan that best suits your needs and enjoy enhanced banking capabilities.

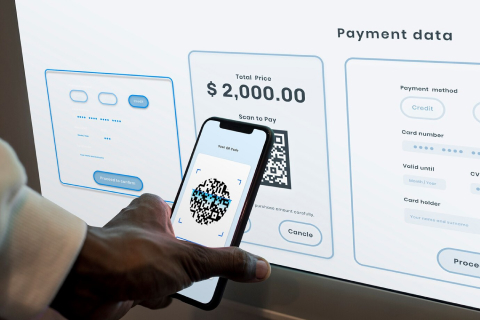

Ready to manage your finances? Navigate to the transaction section where you can initiate transfers, pay bills, or perform other banking activities. Our secure and efficient system ensures that your transactions are processed quickly and accurately.

Securely store funds with various account types such as savings and checking, providing easy access and, in some cases, interest earnings.

Manage and safeguard securities and financial assets through a secure depository system, ensuring efficient transactions and record-keeping.

Invest funds for a predetermined period to earn higher interest rates compared to regular savings, with guaranteed returns.

Facilitate a range of financial transactions including deposits, withdrawals, and transfers, ensuring seamless management of funds.

Access and withdraw funds from a fixed deposit or loan account, offering flexibility while maintaining financial growth.

Access flexible loan options designed to meet your financial needs. From personal to home loans, our streamlined application process and competitive rates make borrowing simple and straightforward.

With two wallets, you can manage funds separately for different purposes or accounts. Typically, one wallet can be used for daily transactions and the other for savings or specific financial goals. Transfers between the wallets can be done seamlessly, allowing for better organization and control of your finances.

Yes, you can manually deposit funds into your account by visiting a branch, using an ATM, or through online banking. Manual deposits allow you to add funds directly to your account without relying solely on automatic transfers or electronic methods.

To withdraw money, you can use an ATM, visit a branch, or access online banking services. Depending on your account type, you may need to follow specific procedures or use your debit card to complete the transaction.

To upgrade your ranking, you typically need to meet certain criteria set by the bank, such as increasing your account balance, maintaining consistent account activity, or achieving specific financial milestones. Check with your bank for detailed requirements and steps to improve your ranking.

Referral levels reward you for referring new customers to the bank. Each referral can increase your level, offering various benefits or incentives. The more successful referrals you make, the higher your level, potentially unlocking greater rewards or perks. Ensure you understand the specific referral program details and criteria set by your bank.